Financial Aid Planning

We can make college financially friendly. We can find out financial friendly colleges.

01Quickly calculate your expected family contribution for both the FM (FAFSA) and IM (PROFILE) college formulas. We use the latest formula data provided by the Federal government as it gets updated each school year.

02

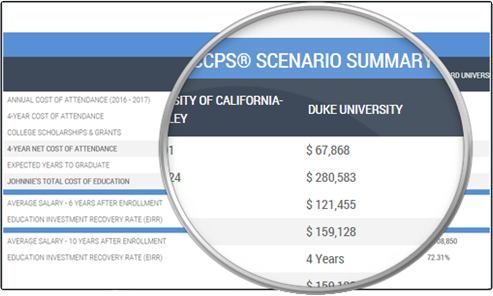

Create and save an unlimited number of “what-if” strategy scenarios for clients. We demonstrate strategy changes in income and assets and quickly compare the impact of your suggested adjustments in a "before" and "after" format. Presenting the total dollar value effect of your strategy savings over the period from college to retirement gives prospects and clients an accurate picture of the value of hiring you to guide them through the process.

03

Drill down the details on each individual college; including the expected annual cost of each college (regardless of the student’s year in high school), the net cost after expected gift aid, average graduation rates, expected total cost at graduation, expected student (Stafford) and parent (PLUS) loan debt analysis, and the academic statistics of each school and the student’s probability of admissions and opportunities at each school. Dramatically improving the student and parent’s ability to make sound admissions and financial decisions.

04

Over 9,000 private scholarships offered by companies, private institutions, and foundations in the U.S.

Search for scholarships and get instant results. Discover WHAT types of scholarships are out there and WHERE & WHEN students should apply?

05

Search for scholarships and get instant results. Discover WHAT types of scholarships are out there and WHERE & WHEN students should apply?

We will evaluate borrowing strategies and recommend the best loan types and repayment options for your unique situation.

06

Tax Savings, Lending, Cash Flow, Income and Expense, and Investment Management strategies that can potentially save your tens-of-thousands of dollars on their children’s college education.

More benefits will be guranteed if you prepare and plan in advance.

View Financial Aid Planning Case Study